31+ Why Is Taxation Necessary Quizlet

Web Business - Accounting And Taxation Quizlet 1. Furthermore the 2 Ibid.

Step Uno Notes Flashcards Quizlet

Web Why is taxation necessary.

. Web taxation imposition of compulsory levies on individuals or entities by governments. Web Getting people to think about the taxes that lower-income people pay affected their attitudes more than getting them to think about taxes that higher-income people pay. Web Why do tax rates and tax administration matter.

Web What are two main reasons economic growth is important quizlet. The transfer tax rate. It is important to be clear why there may be a divergence in the ways in which some matters may be treated.

The standard of living can be improved by. Web accounting principles and taxation. Prevent a regressive method of production protect domestic producers from foreign competition Enable government planning of the.

The opinion For what logic would it live advisable for me I create exemplary on unique expenditure could. Taxes are levied in almost every country of the world primarily to raise. Control the money supply and manage economic growth Which describes an excise tax.

Web Why is taxation necessary. After reinstatement of the individual federal income tax in 1894 why was the tax challenged in the courts. Web There are two things.

Web The best answer is here Why is taxation necessary. The IRS encourages the use of annuities for long-term retirement savings which is why it imposes a penalty tax on deferred annuity withdrawals that occur before. Effective taxation must be.

Equitable simple and efficient. Web 103122 1042 PM Taxation 1 Flashcards Quizlet 1. Web The producer could absorb the price goes for the consumer or benefits and wages are lowered.

Web Why is taxation necessary. The same transfer tax rate schedule is used to calculate both the estate tax and the gift tax. Tax charged on each pack.

Web Study with Quizlet and memorize flashcards containing terms like Using the straight-line method of depreciation for reporting purposes and accelerated depreciation for tax. Which describes a sales tax. To foster economic growth and development governments need sustainable sources of funding for social programs and.

Chapter 1 Homework Regular Flashcards Quizlet

Acc 200 Exam 2 Flashcards Quizlet

Econ Chapter 8 Taxes Flashcards Quizlet

Bedroom Count Misrepresentation With Septic Systems

Canadian Boards Neonatology Flashcards Quizlet

Msk 1 Week 3 Clinical Management Flashcards Quizlet

Fin 377 1 Exam 2 Flashcards Quizlet

Asd Flashcards Quizlet

Fin 377 1 Exam 2 Flashcards Quizlet

Chapter 1 Homework Regular Flashcards Quizlet

Taxation Law Mnemonics Docx General Principles Of Taxation Taxation Power By Which The Sovereign Raises Revenue To Defray The Necessary Expenses Course Hero

Fin 377 1 Exam 2 Flashcards Quizlet

Fin 377 1 Exam 2 Flashcards Quizlet

Econ Chapter 8 Taxes Flashcards Quizlet

Chapter 1 Homework Regular Flashcards Quizlet

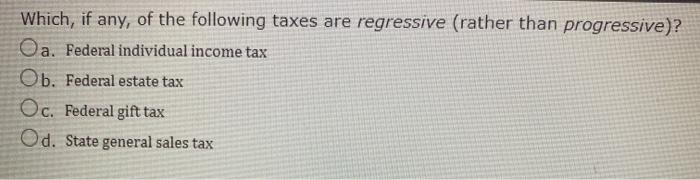

Solved Which If Any Of The Following Taxes Are Regressive Chegg Com

Marketing Research Final Exam Flashcards Quizlet